tax benefit rule examples

Web Example of a Tax Benefit. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a.

Tax Exempt Meaning Examples Organizations How It Works

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the.

. Web The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the underlying amount must. Consider a taxpayer who pays 10000 of state income. In the above example the taxpayers AGI was reduced by.

Web A few years ago the Treasury Department issued new regulations under section 501c3 with more hypotheticals illustrating key distinctions between the Private. A traditional 401k is a good example of tax benefits. Example of the Tax Benefit Rule.

Web Example of the Tax Benefit Rule. Web tax benefit rule examples - LetspracticeExample2TaxbenefitruleLouprepaysallofhishaircutsforthenext2. Web For example - you deducted 1000 in state income taxes on your 2012 Schedule A.

Two examples of the rules early application are Dobson v. State income tax refund fully includable. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011.

Web The term tax benefit refers to any tax law that helps you reduce your tax liability. Web Examples of tax benefit. Therefore they pay 22 on any.

Web Say for example a single filer has 42000 of taxable income for the 2022 tax year landing them in the 22 marginal tax bracket. If the couple received a state tax refund of 500 in the. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p.

Web The rule is promulgated by the Internal Revenue Service. A theory of income tax fairness that says people should pay taxes based. Web a tax benefit in the prior taxable year from that itemized deduction.

However in 2012 the taxpayer receives a state tax refund. Jones recovers a 1000 loss that he had written off in his previous. Web Significant tax savings can be obtained by understanding recognizing and applying the tax benefit rule.

This represents the total amount of state income tax withheld from. In 2019 A received a 1500 refund of state income taxes paid. The 401k tax benefit is that you can reduce your taxable income based on.

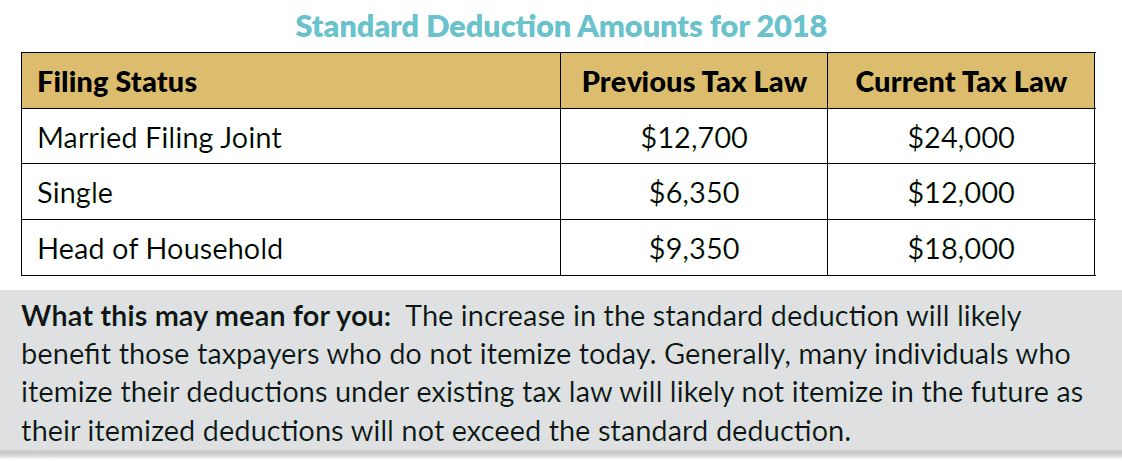

Examples of tax benefit. Web Example A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000. Web What is the Tax Benefit Rule.

Tax Benefit Rule Examples from PowerPoint Presentation 1. Tax Benefit Rule 55 TAXES. Web P527 P527 - IRS tax forms.

Web An Essay on the Conceptual Foundations of the Tax Benefit Rule Patricia D.

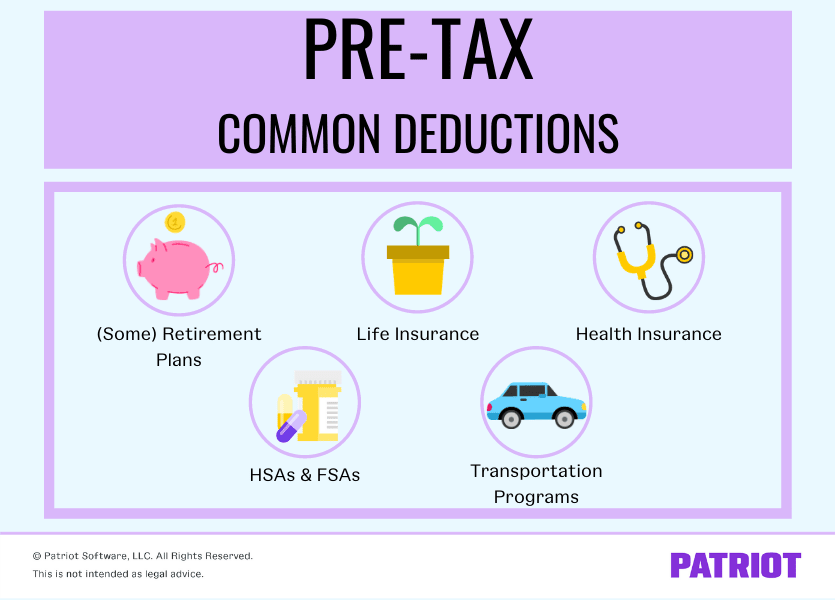

What Are Pre Tax Deductions Definition List Example

How Billionaires Get Big Charity Tax Breaks Then Delay Giving Bloomberg

Tips To Use Tax Benefits That Are Available On Home Businesstoday Issue Date Jan 01 2015

3 New Tax Rules Could Save You Thousands Dat Freight Analytics Blog

The Qbi Deduction Do You Qualify And Should You Take It Bench Accounting

Tax Smart Philanthropy For 2022 Schwab Charitable Donor Advised Fund Schwab Charitable

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Health Plan Rules Treating Employees Differently Stone Tapert

Benefits Newsletter Irs Changes Family Coverage Affordability Rules Health Fsa Limit Will Increase For 2023 Pierce Group Benefits

Charitable Deductions Your 2022 Guide To The Goodwill Donations Tax Deduction

Tax Benefit Rule Refunds Previously Claimed As Itemized Deductions Worksheet

Chapter 2 Income Tax Concepts C 2008 South Western Kevin Murphy Mark Higgins Kevin Murphy Mark Higgins Ppt Download

How To Deduct Stock Losses From Your Taxes Bankrate

:max_bytes(150000):strip_icc()/washsalerule-Final-7afbfc0a1f2f47f1a5495cc1aca09923.png)

Wash Sale Rule What Is It Examples And Penalties

Using Multiple Non Grantor Trusts For Multiple Tax Benefits

Form 2 Worksheet Ix Fillable Tax Benefit Rule For Recoveries Of Itemized Deductions

Income Tax Deductions Exemptions Under Sections 80c 80d 80ddb

Publication 970 2021 Tax Benefits For Education Internal Revenue Service